Nedbank has partnered with research agency African Response and CanPro, an organisation that specialises in digital interventions aimed at creating opportunities and exposure to enable youth and communities to participate in the 4th Industrial Revolution.

Through this partnership, Nedbank and African Response developed a new online consumer financial education training programme to reach rural communities in South Africa.

This platform will be rolled out in an initial pilot phase, giving digital enterprises the opportunity to earn an income by training over 5000 residents in Mokopane, Limpopo on key and fundamental finance concepts. Since launching in October, the project has reached and empowered almost 3300 consumers in the Mokopane community to date.

“This ground-breaking project brings impactful financial education that helps individuals and families make better money decisions that yield long-term benefits,” says David Dickson, Strategy Manager at Nedbank. “Through technology, we are able make savings and investment concepts readily accessible, easy to understand and simple to navigate for all South Africans, empowering and supporting them to achieve their financial goals and dreams.”

This programme forms part of Nedbank’s Consumer Financial Education programme to equip consumers with the financial knowledge and skills to make informed and effective decisions with their resources.

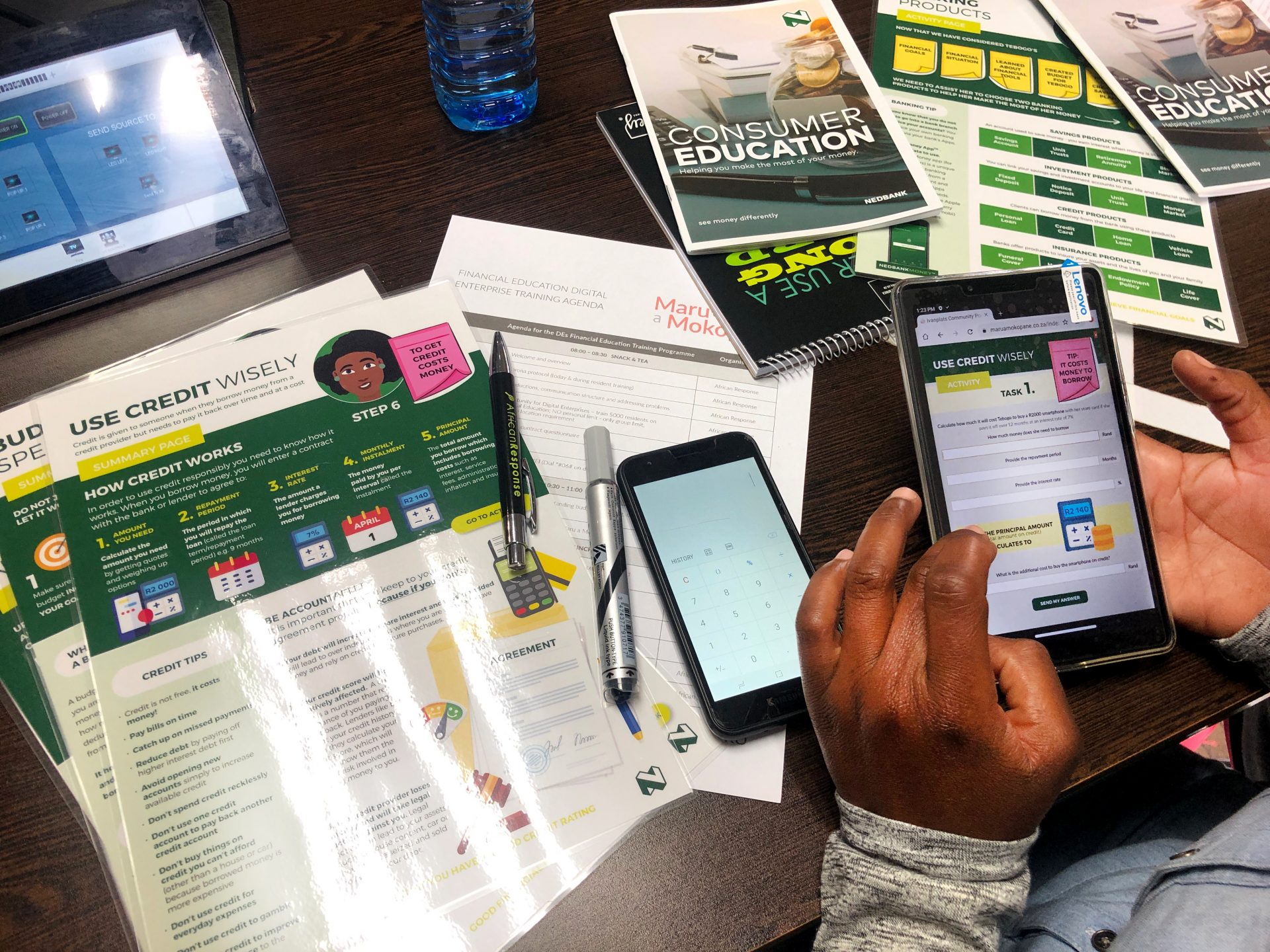

Nedbank and African Response provided the curriculum material and leveraged CanPro’s mobile community engagement platform to reach people directly on their devices. The project also enlisted local youth enterprises already providing online training to residents on a range of online services. Digitisation and gamification of content are used to explain financial concepts and encourage the use of online tools provided to support consumers.

The digital youth enterprises were equipped with the necessary training and equipment to effectively educate members of their communities on how to access and complete the financial education online programme, which includes maintaining financial health, budgeting for financial health, the importance of saving, understanding credit and banking products and services.

“This project is driven by more than an altruistic motive,” says Gerard Naidoo, Operations Director at African Response. “It is vital for financial institutions that their consumers understand how banking products and services support their personal financial goals, in order for them increase their financial health, which, in turn, supports the economy as a whole.”

Together, Nedbank, African Response and CanPRO aspire to roll out this project to other rural communities in South Africa following the success of the Mokopane rollout.

The programme can be accessed in the “Financial Education Section” of www.Maru.community

Article, curtesy of www.bytesites.co.za

To read the full article click here – https://www.bytesites.co.za/2020/12/02/nedbank-offers-financial-education-to-rural-communities